Jakarta (Greeners) – Forests and Finance, an organization that exposes the risk of deforestation by banks and investors, reveals money invested in Indonesian Financial Services Institutions (LJK) harms the environment. In “Is Your Money Destroying or Violationg Right” discussion (22/09/20), researchers found four Indonesian banks are part of Southeast Asia’s biggest creditors for the deforestation risk sectors.

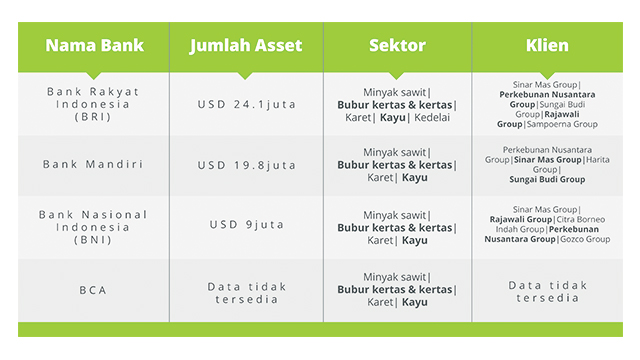

These four largest Indonesian creditors are Bank Rakyat Indonesia (BRI), Bank Nasional Indonesia (BNI), Bank Mandiri, and Bank Central Asia (BCA). Three of the four banks are State-Owned Enterprises (BUMN). The Indonesian bank giants fund sectors that are at risk of destroying forests. The deforestation risk sectors are the pulp and paper, palm oil, rubber, timber, and soybean sectors.

Transformation for Justice (TuK), Rainforest Action Network (RAN), and Profundo are some of the organizations involved in Indonesia’s data collection.

“Public can see all data on financial institution funding for companies related to sectors and their impact on the environment on the Forests and Finance website. However, we do not have all the companies’ data,” said TuK Executive Director, Edi Sutrisno, to Greeners.co (29/09/20).

Also read: Experts: Rhino Population in Indonesia Less than One Hundred

Indonesian Bank Giants Score Bad on Policy Assessment

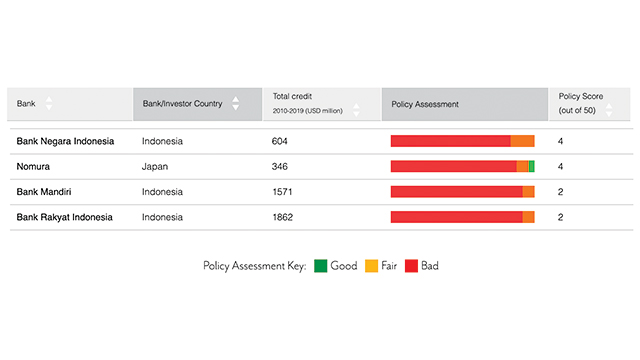

Furthermore, Forests and Finance data shows the four major Indonesian banks that invest in deforestation risk sectors also score low on policy and transparency. Edi emphasizes the importance of openness to the public.

“The majority of LJKs do not know their clients, their subsidiaries, and the supply chains of the group companies. This is not only the responsibility of LJK and the Financial Services Authority (OJK), but it requires synergy with other parties,” Edi argues.

According to Edi, OJK should encourage other state institutions such as the Ministry of Law and Human Rights, the Ministry of Agrarian Affairs and Spatial Planning/National Defense Agency, the Ministry of Agriculture, and the Ministry of Environment and Forestry to ensure companies are transparent in reporting their business entities.

Edi also hopes that LJK will not only focus on the company but also pay attention to the company’s commitment to the conservation of flora and fauna.

Also read: BMKG: Forest Fires Worsen Ozone Depletion

Researcher: ‘Some Data is Not Recorded’

Echoing Edi’s statement, RAN’s Responsible Finance Senior Campaigner, Hana Heineken, states the importance of data transparency from LJK.

“The issue of investment and forests continues to increase from time to time. We can monitor this issue, like bank policies, from the Forests and Finance data. The data will continue to be updated to see whether there are changes or not,” says Hana.

Speaking on the same topic, Ward Warnerdan from Profundo acknowledges the difficulty of obtaining data from the country.

“The data collection process in this study encountered several obstacles. Not all data can be easily obtained because some data is not recorded,” says Ward at the same event.

In presenting the data, Ward continues, there were several processes. It begins by listing the companies according to the existing sector. The data is then managed using a methodology divided into three: deal contributions, segment adjusters, and geographic adjusters.

Reporter: Maria Soterini

Editor: Ixora Devi